TQQQ with Moving Average Rotation

2021-04-28

I recently found this post on Reddit, "Backtesting TQQQ's hypothetical performance over 50 years with moving average rotation", and wanted to duplicate it here in case it is deleted:

I found an great article and paper on a straightforward trend-following method that historically reduce the risks of holding leveraged ETFs without touching the upside.

As long as the S&P 500 is above its 200-day moving average, buy and hold UPRO. When the S&P 500 sinks below its 200-day moving average, rotate to cash.

The worst trading days have historically happened when the S&P 500 was below its 200 day moving average, in addition to avoiding some sharp declines, this strategy also reduced the effects of volatility drag. While returns are hard to predict, volatility has been consistently higher when the S&P 500 is below it's 200 day moving average. Volatility drag increases with leverage, so rotating into cash when the S&P 500 is below it's 200 day moving average could prevent leveraged ETFs from underperforming their indices.

I wanted to see how this strategy would perform on TQQQ, but TQQQ only goes back to 2010 so it lived most of its life in a bull market.

To get around this, I simulated a daily rebalanced 3x leveraged ETF with an expense ratio of 1%, tracking the NASDAQ composite since 1970 and the NASDAQ-100 since 1985. I'm probably not the only person to try backtesting this, but it seemed like a good learning opportunity.

The NASDAQ 100 and NASDAQ composite are highly correlated, so even through TQQQ tracks the NASDAQ 100, I used the NASDAQ composite for this analysis because it gives me 15 more years of data and an extra market crash. If this is a bad assumption, let me know!

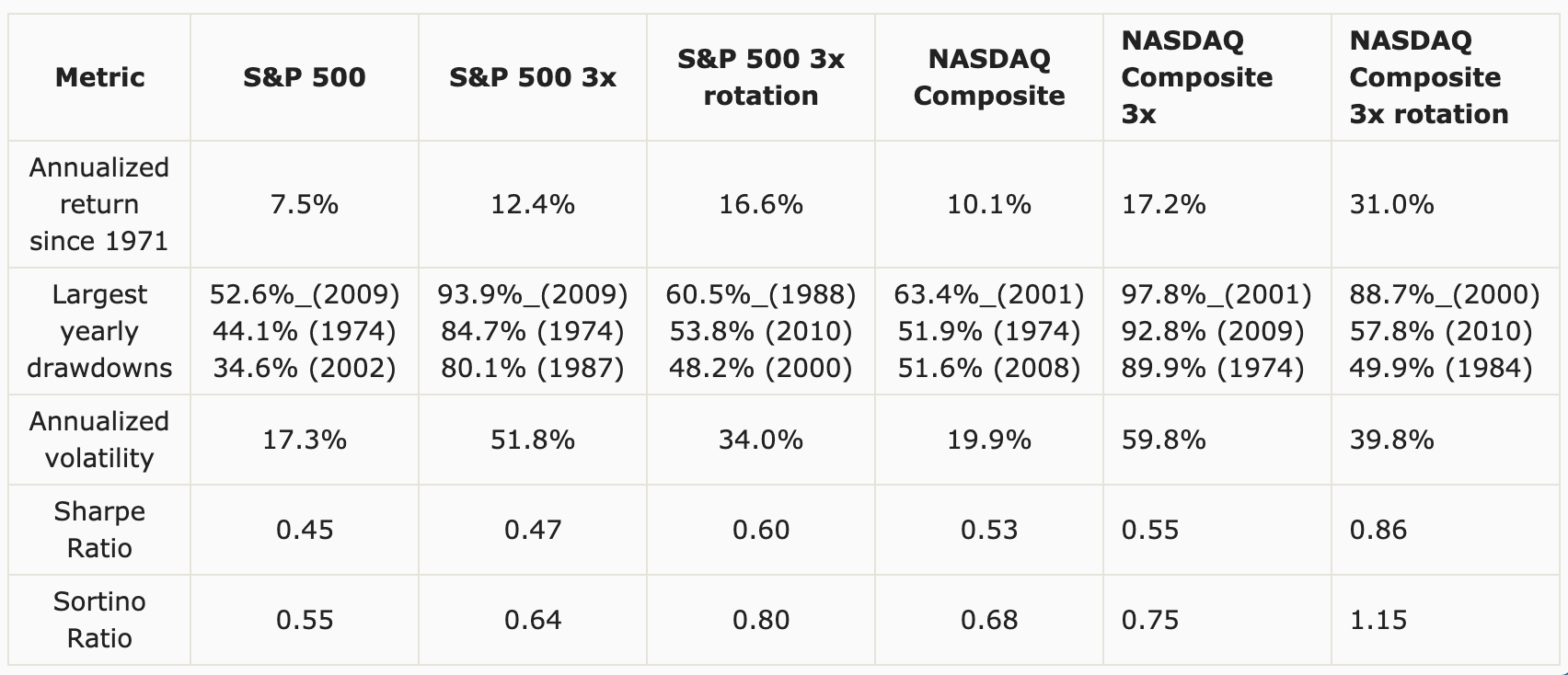

Here's the NASDAQ Composite's and S&P 500's performance, comparing holding the index, holding a 3x leveraged fund, and rotating between the leveraged fund and cash when the S&P 500 crosses it's 200 day moving average.

This strategy would have avoided some of the largest drawdowns in both the NASDAQ and S&P500. From 1995 to 2005, QQQ would have increased by ~240%, while TQQQ would have only increased by ~30% due to volatility and the dot-com bubble. However, by rotating into cash when the S&P 500 crossed it's 200 day moving average, you would have gained ~1400% from 1995 to 2005!

As seen here, moving average rotation substantially lowers otherwise enormous drawdowns during extended bear markets. A 3x leveraged NASDAQ fund would have an annualized return of 31% over the last 50 years with this strategy.

I'm still new at this and it's quite possible I missed something obvious so I'd love to people's opinion on this method!

I have been researching leveraged ETFs buy and hold strategies for my riskier 10% of my investment strategy. I see a lot of advice against buying and holding leveraged ETFs, but most of it revolves around assumptions that the investor will panic sell and hand-wavey fearmongering about decay boogey men. And it seems most naysayers assume people want to go 100% into the leveraged ETF. This is only 10% of my portfolio and I am fully prepared to lose all of this money.

So I am starting today and will be investing at least $240 per month into this strategy. I plan to update this page every six months. I'm using M1 Finance to automatically invest on a weekly basis. I would use Robinhood, but they don't allow automatic investments into leveraged ETFs.

April 28, 2021:

Current Allocation: 100% TQQQ

Balance: $268.87

Cost: $270.00

Return: -0.42%

S&P 500: 4,190.77

S&P 500 200 day MA: 3,645.58October 27, 2021:

Current Allocation: 100% TQQQ

Balance: $8,268.22

Cost: $7,196.59

Return: +14.89%

S&P 500: 4,551.68

S&P 500 200 day MA: 4,202.16

SPY Return: 8.97%